Worldwide tablet shipments decline 19.1% YoY Q1 2023 IDC

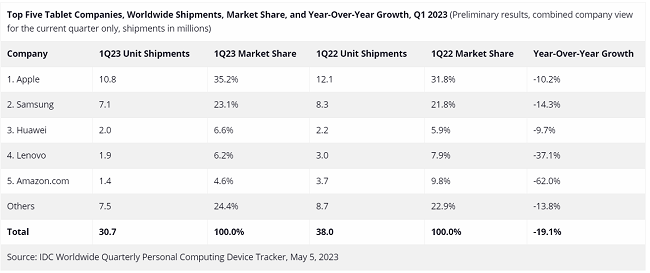

Global tablet shipments fell by 19.1% year over year in 1Q23, to a total of 30.7 million units, according to data from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. This is a significant drop from the 3.3% YoY decline reported by IDC in the previous quarter.

Shipment Volume Comparison to Pre-Pandemic Levels

The shipment volume in Q1 2023 is comparable to the levels of 1Q19 and 1Q18, which indicates a decrease in shipment volumes. The vendors are focusing on clearing out their inventory before the launch of newer models, which is causing a low sell-in shipment in the first half of 2023.

Chromebook shipments have also declined, with a year-over-year decrease of 31%. However, the drop in shipments was smaller as vendors advanced orders due to a projected rise in the Chrome OS licensing fee in the latter half of 2023.

Tablet Market Performance in 2023

All top tablet vendors have witnessed a decline in the quarter, which is due to weakening demand as employees return to offices and consumers remain cautious of their expenditures. However, signs of global economic recovery, including easing inflation, could improve shipments in the second half of 2023.

Apple and Samsung led the market, making up nearly 58% of the tablet market. Huawei secured the third position this quarter, with Lenovo in fourth and Amazon in fifth. Amazon’s tablet shipments plummeted by 62% compared to the same period last year, the worst performance since the pandemic started, which could be explained by seasonal factors, excess inventory, and weak demand.

Top Five Tablet Companies, Worldwide Shipments, Market Share in Q12023

- Apple topped the chart with 10.8 million tablets shipped and a 35.2% market share.

- Samsung followed with 7.1 million tablets shipped and a 23.1% market share.

- Huawei came third with 2.0 million tablets shipped and a 6.6% market share.

- Lenovo ranked fourth with 1.9 million tablets shipped and a 6.2% market share.

- Amazon.com placed fifth with 1.4 million tablets shipped and a 4.6% market share.

- The remaining companies shipped 7.5 million tablets and had a 24.4% market share.

Increasing Vendors’ Interest in Tablet Market

Jitesh Ubrani, Research Manager at IDC’s Mobility and Consumer Device Trackers, says that despite the decline in tablet shipments, there is some hope as more vendors are showing interest in the space.

The recent debut of OnePlus and the upcoming Pixel Tablet from Google show a demand from the supply side. Google’s comeback is especially noteworthy as it could enhance Android’s tablet experience while also making the tablet a key part of the smart home.

Top Five Chromebook Companies, Worldwide Shipments, Market Share in Q12023:

- HP topped the chart with 1.1 million Chromebooks shipped and a 27.8% market share.

- Lenovo followed with 0.8 million Chromebooks shipped and a 21.3% market share.

- Acer Group came third with 0.8 million Chromebooks shipped and a 21.2% market share.

- Dell ranked fourth with 0.5 million Chromebooks shipped and a 12.9% market share.

- Samsung placed fifth with 0.3 million Chromebooks shipped and a 7.8% market share.

- The remaining companies shipped 0.3 million Chromebooks and had a 9.0% market share.

Speaking on the report, Anuroopa Nataraj, Senior Research Analyst with IDC’s Mobility and Consumer Device Trackers, said:

Tablet vendors approached the first quarter of 2023 with apprehension, as both commercial and consumer volumes were subdued due to the uncertain macro environment that persisted throughout the quarter. Despite this, it is worth noting the favorable effect that pandemic-induced restrictions had on the adoption of tablets, and how several vendors capitalized on this opportunity by developing and launching models that catered to the various use cases that emerged during the lockdowns and beyond. Large screen tablets, in particular, witnessed a notable increase in market share compared to pre-pandemic levels, owing to their suitability for remote learning and hybrid work scenarios.