Paytm UPI SDK Mobile Apps launched

Paytm has unveiled the Paytm UPI Plugin SDK, offering a convenient solution for UPI payments in mobile apps. According to Paytm, UPI payments have reached impressive heights, with 9.4 billion transactions recorded in May 2023 alone.

The national UPI switch boasts a remarkable 99.9977% success rate. However, the industry faced challenges in February 2023 due to heavy loads and increased user adoption, resulting in a 6.83% decline in UPI payment volume.

Paytm’s Solution: UPI Lite

During this period, Paytm took the lead by introducing UPI Lite in partnership with NPCI. UPI Lite revolutionized small-ticket payments in India, offering a fail-proof payment experience. Within just three months, UPI Lite attracted 7 million users, transforming the way such payments are made.

Enhanced Online Payment Experience with Paytm UPI Plugin SDK

The Paytm UPI Plugin SDK promises to revolutionize online payments by eliminating technical failures and optimizing the payment process. It ensures a direct and seamless payment experience, eliminating unnecessary steps and enhancing overall efficiency.

With its range of smart features, the Paytm UPI Plugin SDK significantly improves the success rates of customer payments. It outperforms traditional solutions and provides a streamlined experience for both businesses and customers.

Paytm envisions a seamless UPI payment experience that never crashes. By introducing the UPI Plugin SDK as an essential accelerator, Paytm propels online businesses to new heights of success, offering a reliable and efficient payment solution.

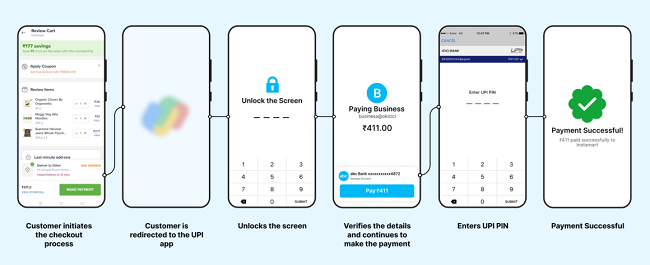

Challenges of Current UPI Payment Journey

Paytm highlights the limitations of the current UPI payment process and its frequent failures. The UPI payment journey involves five steps, taking around 20 seconds. Compared to other options, it has a low success rate of 80-85%.

Reasons for Low Success Rate

- Dependency on Pre-Installed UPI Apps: Customers must have a pre-installed UPI app for successful transactions.

- Multiple Hops and Drop-offs: The payment flow includes multiple hops, leading to interruptions and drop-offs.

- Server-to-Server Calls and Payload Increase: Several server calls result in increased payload during peak times, causing delays.

- Legacy Infrastructure Challenges: Non-Paytm UPI flows rely on outdated infrastructure, struggling with high loads during peak periods.

Paytm UPI SDK for UPI Payments

Paytm introduces the revolutionary Paytm UPI Plugin SDK, offering a seamless and reliable UPI payment experience within your app. The Paytm UPI Plugin SDK eliminates the need to leave your app for UPI payments, ensuring fail-proof and lightning-fast transactions.

It reduces taps by 5X compared to UPI intent and eliminates external redirection, resulting in faster transactions, higher success rates, and improved customer retention.

- The new checkout flow powered by Paytm UPI SDK guarantees payment success rates exceeding 90%.

- It enables customers to complete payments with a single tap, reducing the processing time to as low as 3-5 seconds.

Reasons to Choose Paytm UPI SDK for Your Mobile App

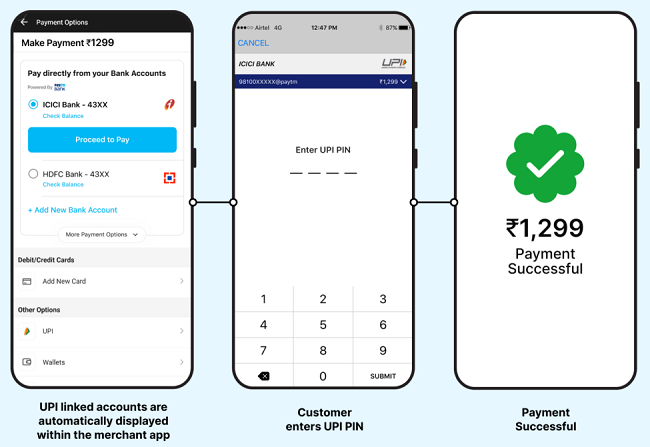

- Streamlined Payment Flow: Paytm UPI SDK offers a single-tap payment process with faster processing, boosting success rates to over 90%.

- Powered by Paytm Payments Bank: Paytm’s integrated payment gateway and PSP bank ensure superior UPI technology, leading to improved success rates and access to the latest UPI innovations.

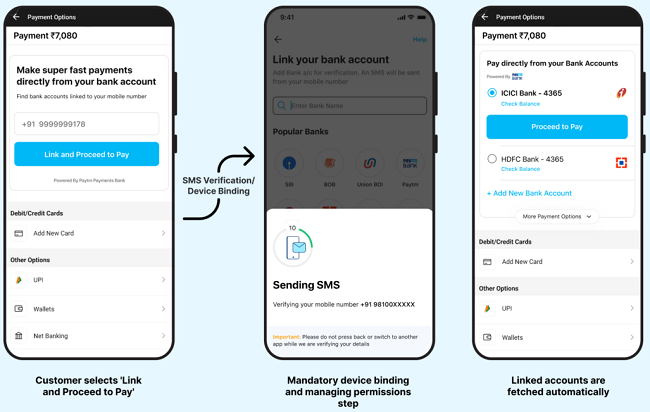

- Enhanced Payment Options and Lower Failure Rates: Support for linked bank accounts and RuPay credit cards reduces payment failures. Future integration with UPI Lite eliminates small-ticket payment failures.

- Seamless Account Linking: Paytm users enjoy a hassle-free account linking process, minimizing failures and drop-offs during payment setup.

- Fail-Proof Integration: Paytm UPI SDK addresses common causes of payment failures, such as insufficient account balance and UPI PIN issues, with features like real-time bank status and in-app UPI PIN management.

- Lightning-Fast Payments: With Paytm UPI Plugin SDK, checkout takes less than 5 seconds, ensuring a swift payment experience.

- Privacy Protection: Paytm UPI SDK offers a secure in-app payment experience without sharing sensitive customer data, prioritizing privacy and security.

- Easy Customization: Seamless integration and customizable UI themes allow businesses to apply their brand identity to the checkout screen, enhancing customer trust and improving payment success rates.

The Importance of Fail-Proof and Intuitive UPI SDK

Paytm emphasizes that speed alone is not enough. Just like the fastest car needs precise braking and safety features, a UPI SDK must be fail-proof and intuitive to ensure a successful payment experience.

If you’re undecided about which UPI SDK to choose for your mobile app, the following comparison table provides insights.

Availability

The all-new, Paytm UPI SDK is now available to existing Paytm merchants.