![]()

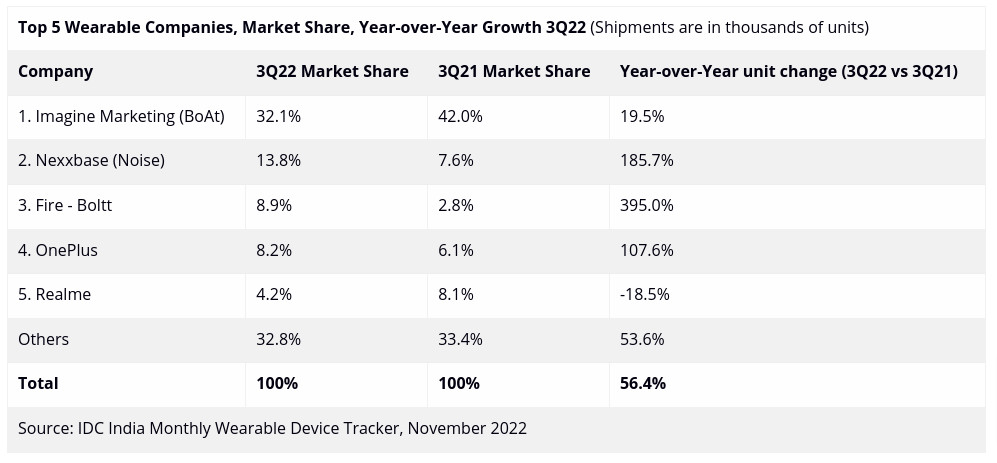

The International Data Corporation (IDC) has posted shipments data for wearables in India for the third quarter (Q3) of 2022. This is another record quarter, will 37.2 million unit shipments, up 56.4% YoY. Totally, the shipments have hit 75 million in the first 9 months.

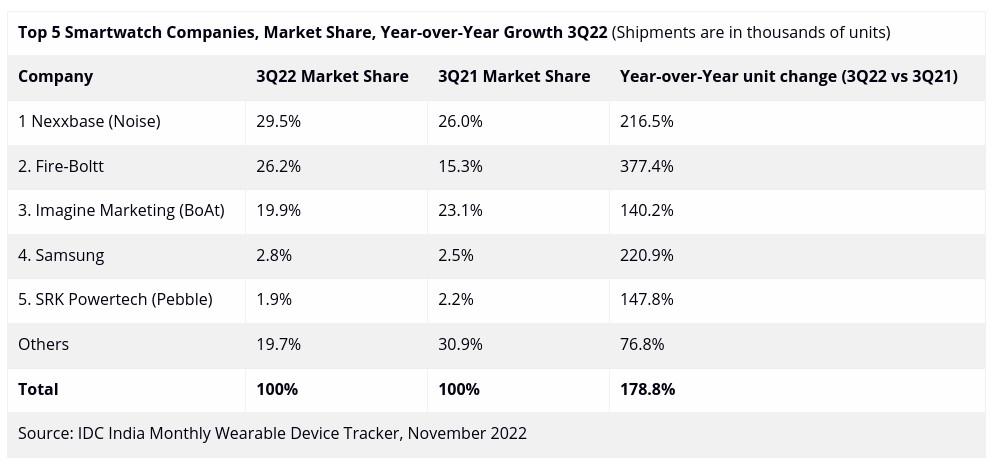

Smartwatch remained the fastest-growing category, crossing the 12 million shipments mark in a single quarter, posting 178.8% YoY growth. However, smartwatch ASP declined by 30.3% YoY to reach $41.9 compared to $60 a year back. Basic smartwatches lead the market with 95.5% share, posting 187.1% YoY growth. Wristbands saw yet another quarter of annual decline with an 80.8% YoY shipment drop.

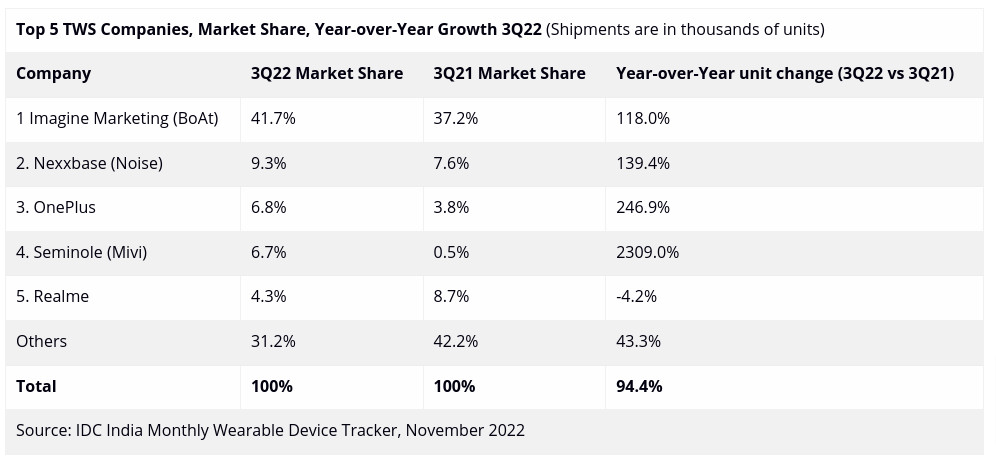

Truly wireless (TWS) headset lead the earwear category with 57.6% share growing by 94.4% YoY, tethered grew by 2.5%, while over-the-ear declined by more than 50% in Q3 2022.

boAt continues to lead with a 32.1% market share and posted 19.5% YoY growth. Airdopes 141 and Airdopes 131 were top sellers in TWS headset and the shipments of Xtend and Wave Call were high in the smartwatch category.

Noise had a 13.8% market share in wearables market, and lead the smartwatch markets, posting 216.5% YoY growth annually. The company’s Colorfit Caliber and Colorfit Icon Buzz smartwaches accounted for more than 30% of its overall shipments.

Fire – Boltt climbed to third place in the wearables category with 395% YoY growth and 8.9% share. It had 26.2% market share in smartwatch category, driven by high shipments for Ninja Pro Max, Ring 3 & Ninja Bell watches.

Mivi grew by 1921.1% YoY in the earwear category and is at the fourth place in TWS headset category.

OnePlus dropped to fourth place in the overall wearable category, but it gew 107.6% YoY. In TWS category, it grew 246.9% YoY. Bullets Wireless Z2 contributed as the key model.

realme was the only vendor amongst the top 5, with 18.5% decline in shipments. This is due to fewer launches and low focus in the wearable category. Buds Wireless 2 Neo and the Buds wireless 2s accounted for 35.7% of the overall shipments.