India smartphone shipments decline 5% YoY in Q1 2022: IDC

According to the new report from market research company International Data Corporation, smartphone shipments in India fell to 37 million units in the first quarter of the year 2022.

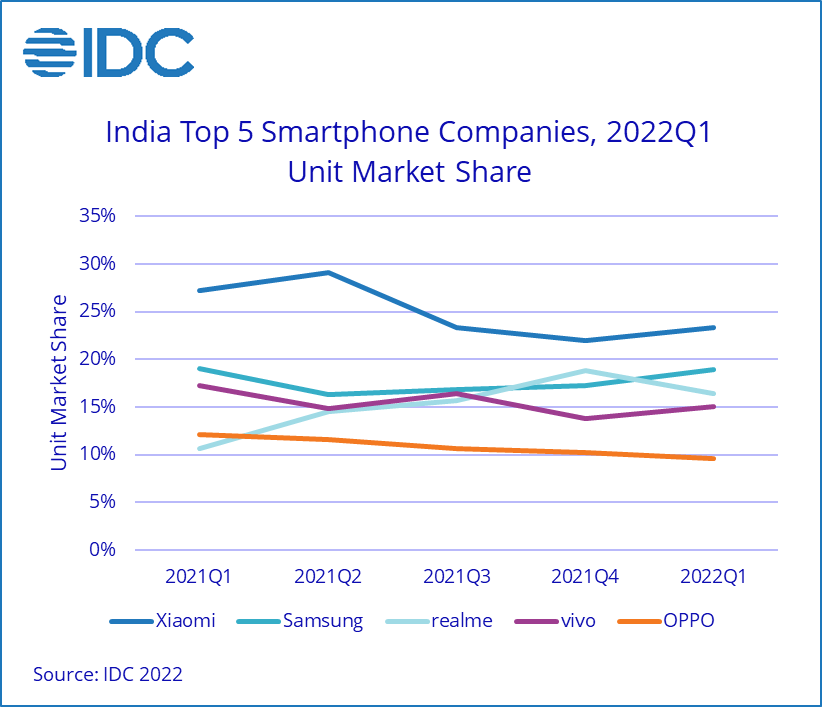

According to a survey, smartphone shipments in India fell for the third quarter in a row, falling 5% year-on-year in the first quarter of 2022. Although Xiaomi retained the market leader, all the top five vendors reported a drop in shipments in the quarter, except for realme.

The effect of the third wave of COVID-19, supply restrictions, particularly in the low-end pricing classes, and growing inflation, which is increasing the cost of ownership of smartphones throughout all price segments, are seen to be major factors for the decline. Global smartphone shipments also saw a decline of 8.9% YoY in Q1 2022.

India smartphone shipments Q1 2022

- Xiaomi maintained its dominance despite an 18% drop in shipments year-over-year (YoY). It maintained its lead in the online market with a 32% share, thanks to its sub-brand POCO.

- Samsung reclaimed second place, despite a 5% drop in the first quarter of 2022. The Galaxy S22 series witnessed a large presence in the first quarter, with remarkable pre-orders, particularly in the offline

- channel. It also maintained a 29% market share in the 5G segment, with the most popular models being the Galaxy M32 and Galaxy A22.

- realme was placed 3rd, but it was the only company in the top five to expand by 46% year over year.

- Vivo came in fourth place, with a 17% decrease in shipping year over year. Online shipments are likely to increase over the coming quarters thanks to the debut of the new T series, including additions to its

- sub-brand iQOO.

- OPPO dropped 25% and ranked fifth in the rankings.

Speaking on the announcement, Upasana Joshi, Research Manager, Client Devices, IDC India, said,

5G accounted for 31% of shipments with an ASP of US$375 in 1Q22. IDC estimates that shipments beyond US$300 will be fully 5G by the end of 2022.

Navkendar Singh, Research Director, Client Devices & IPDS, IDC India, said

The outlook for 2022 remains cautious from the consumer demand standpoint. Due to rising inflation and lengthening of the smartphone refresh cycle, IDC expects 2Q22 also to remain muted, while smartphone supplies gradually return to normal, resulting in a slower 1H22 compared to 72 million shipments in 1H21.